The Series 66 exam, or Uniform Combined State Law Examination, tests knowledge of securities and investment advisory principles․ It requires thorough preparation using a study guide and practice exams to ensure success․

Overview of the Series 66 Exam

The Series 66 exam, known as the Uniform Combined State Law Examination, is designed to assess knowledge of securities and investment advisory principles․ It is a closed-book test, emphasizing the need for comprehensive preparation․ The exam covers essential topics such as securities, state and federal laws, and ethical practices․ Candidates typically require 75-100 hours of study over 4-8 weeks to adequately prepare․ Utilizing a study guide and practice exams is crucial for success․ The exam consists of 110 questions, focusing on both theoretical and practical aspects of the financial industry․ Passing the Series 66 exam is a key step for professionals seeking to work in securities and investment advisory roles․

Importance of the Series 66 Study Guide

The Series 66 study guide is essential for exam preparation, offering a comprehensive overview of key topics and test-taking strategies․ It provides structured content, covering securities, investment principles, and regulatory requirements, ensuring candidates understand the exam’s scope․ The guide includes practice questions and detailed explanations, helping individuals identify and address weaknesses․ By following the study guide, candidates can efficiently manage their preparation time and build confidence․ It serves as a primary resource for mastering the material, making it indispensable for achieving success on the Series 66 exam․ Regular use of the guide enhances knowledge retention and improves problem-solving skills, critical for passing the exam․

Structure of the Series 66 Exam

The Series 66 exam is a closed-book, 75-question test with a 180-minute time limit․ It covers securities, investment advisory principles, and state and federal securities laws․ Questions are divided into two main sections: securities products and services, and ethical and legal considerations․ The exam requires a deep understanding of key concepts and the ability to apply them in practical scenarios․ Proper time management and thorough preparation are essential to successfully complete the exam within the allotted time frame․ A well-structured study guide and practice exams are critical tools for mastering the exam’s format and content․ They help candidates build confidence and ensure readiness for the challenges of the Series 66 exam․

Exam Format and Content

The Series 66 exam is a closed-book, multiple-choice test consisting of 75 questions․ Candidates have 180 minutes to complete the exam, which covers a wide range of topics, including securities, investment advisory principles, and state and federal securities laws․ The exam is divided into two main sections: securities products and services, and ethical and legal considerations․ Questions are designed to assess the candidate’s ability to understand and apply key concepts in real-world scenarios․ A score of 72% or higher is required to pass․ The exam format ensures that candidates demonstrate a comprehensive understanding of the material, making it essential to use a detailed study guide for preparation․ Proper time management and a thorough grasp of the content are critical for success․

Key Topics Covered in the Series 66 Exam

The Series 66 exam covers a broad range of topics, focusing on securities, investment products, and state and federal laws․ Key areas include types of securities such as stocks, bonds, and mutual funds, as well as investment advisory principles and ethical practices․ Candidates are tested on their understanding of regulatory frameworks, including the Uniform Securities Act and related rules․ The exam also emphasizes fiduciary responsibilities, suitability requirements, and prohibited practices․ Additional topics include retirement plans, taxation of securities, and portfolio management strategies․ A strong grasp of these areas is essential for success, making a comprehensive study guide a critical resource for exam preparation․

How to Use the Series 66 Study Guide Effectively

Focus on key topics, integrate practice questions, and maintain a consistent study schedule to maximize the guide’s benefits and ensure comprehensive exam preparation․

Understanding the Study Guide Content

The Series 66 study guide is structured to cover all exam topics, including securities, investment advisory principles, and ethics․ It provides detailed explanations, practice questions, and a quick reference sheet to help candidates grasp complex concepts․ With comprehensive coverage, the guide ensures that learners understand both state and federal securities laws․ By focusing on real-world examples and practical applications, the content prepares individuals for the exam’s challenging questions․ Regularly reviewing and practicing with the guide enhances retention and confidence, making it an essential tool for successful exam preparation and professional development in the financial industry․

Creating a Study Schedule with the Guide

Creating a structured study schedule with the Series 66 study guide is crucial for effective preparation․ Break down the material into manageable sections, allocating specific topics to each study session․ Dedicate time for both reading and practicing questions to reinforce understanding․ Incorporate regular reviews of key concepts and ethics to ensure retention․ Use the guide’s practice exams to assess progress and identify weak areas․ Schedule weekly reviews to consolidate learning and adjust your plan as needed․ Consistency is key to mastering the exam content and staying on track․ By following a well-organized schedule, you can efficiently prepare for the exam and achieve your goal of passing the Series 66․

Recommended Study Materials for Series 66

The official Series 66 study guide is essential for preparation․ Kaplan’s exam manual and STC study materials provide detailed insights․ Practice exams help assess readiness effectively․

Official Series 66 Study Guide

The official Series 66 study guide is the primary resource for exam preparation, offering comprehensive coverage of all test topics․ It is designed by exam developers to ensure alignment with the exam’s content․ The guide provides detailed explanations of securities, investments, and state and federal laws, as well as ethics and professional conduct․ It includes practical examples and key concepts to help candidates understand complex topics․ Available in digital and PDF formats, the guide is accessible through the North American Securities Administrators Association (NASAA) and other reputable providers like Kaplan․ It serves as the foundation for a successful study plan, complementing practice exams and other preparation materials․ Regular updates ensure it reflects the latest regulatory changes and exam requirements, making it indispensable for achieving success on the Series 66 exam․

Additional Resources for Preparation

Beyond the official study guide, candidates can utilize additional resources to enhance their preparation․ Kaplan Financial Education offers comprehensive exam manuals and practice question banks, while Solomon Exam Prep provides interactive study materials․ STC Study Materials include chapter manuals and final examinations with detailed explanations․ Online platforms like ExamFX offer video tutorials and practice exams, simulating real test conditions․ Flashcards and quick sheets are also valuable for reviewing key concepts․ Furthermore, joining online forums or study groups can provide additional insights and tips from experienced candidates․ These resources complement the official guide, helping candidates deepen their understanding and retention of critical exam content․ They are essential for a well-rounded and effective study strategy․

Key Concepts to Focus On

The exam emphasizes securities, investments, and state/federal laws․ Understanding ethics, professional conduct, and regulatory requirements is crucial for success in the Series 66 exam․

Securities and Investments

Understanding securities and investments is a critical component of the Series 66 exam․ This section covers various types of securities, including stocks, bonds, mutual funds, and ETFs․ Candidates must grasp key investment concepts such as risk and return, diversification, and investment strategies․ The study guide emphasizes the importance of analyzing financial instruments and their suitability for different investor profiles․ Additionally, it delves into the principles of portfolio management and the role of securities in achieving investment objectives․ Mastery of these concepts is essential for both passing the exam and providing effective investment advice in real-world scenarios․

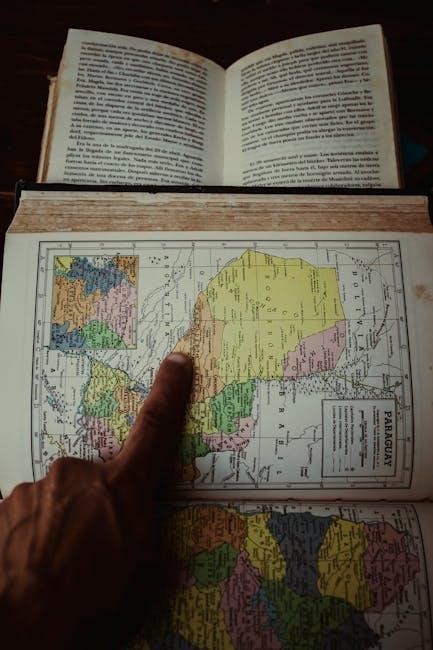

State and Federal Securities Laws

Understanding state and federal securities laws is a cornerstone of the Series 66 exam․ The exam thoroughly tests knowledge of regulations governing securities transactions, including the Securities Act of 1933 and the Investment Advisers Act of 1940․ Candidates must familiarize themselves with rules regarding investor protection, fraud prevention, and disclosure requirements․ The study guide provides detailed insights into state-specific laws and their alignment with federal regulations․ Additionally, it covers exemptions from registration and the penalties for non-compliance․ Mastery of these legal frameworks ensures compliance with regulatory standards and prepares candidates to navigate the complexities of securities and investment advisory practices effectively․

Ethics and Professional Conduct

Ethics and professional conduct are integral to the Series 66 exam, emphasizing the importance of maintaining high standards in the securities industry․ The study guide covers key ethical principles, such as fiduciary duty, confidentiality, and fairness in dealing with clients․ It also addresses potential conflicts of interest and the consequences of unethical behavior․ Candidates learn about industry regulations that promote transparency and accountability, ensuring they understand the responsibilities associated with advising clients․ The guide provides practical examples and case studies to illustrate ethical dilemmas and appropriate responses․ By mastering this section, candidates demonstrate their commitment to upholding professional integrity and adhering to regulatory standards in their practice․

Practice Exams and Their Role

Practice exams are crucial for familiarizing candidates with the exam format, identifying weak areas, and improving time management․ They build confidence and readiness for the actual test․

Importance of Practice Questions

Practice questions are essential for mastering the Series 66 exam, helping candidates understand the content, identify knowledge gaps, and refine problem-solving skills․ They simulate real exam conditions, enabling test-takers to assess their readiness and improve time management․ Regular practice builds confidence and familiarizes candidates with question formats, ensuring a polished performance on exam day․ Utilizing practice questions from reliable sources, such as Kaplan or Solomon study materials, provides targeted preparation and enhances overall understanding of key concepts․ This iterative process is vital for achieving success in the Series 66 exam and becoming a licensed professional in securities and investment advisory services․

Using Mock Tests for Assessment

Much tests are a critical tool for assessing readiness for the Series 66 exam, allowing candidates to evaluate their knowledge and identify areas needing improvement․ By simulating real exam conditions, mock tests help candidates practice time management and build confidence․ Regularly taking mock tests enables learners to track progress and refine their understanding of key concepts․ Utilizing resources like Kaplan or Solomon study materials ensures access to realistic practice questions․ Mock tests also familiarize candidates with the exam format, reducing anxiety and improving performance․ Incorporating mock tests into study routines is essential for achieving a high score and successfully passing the Series 66 exam․

Common Challenges and Solutions

Candidates often struggle with time management and complex topics․ Solutions include creating a study schedule, using flashcards, and taking regular mock tests to build confidence and mastery․

Difficult Areas in the Series 66 Exam

Candidates often find ethics, state and federal securities laws, and investment advisory topics challenging․ These areas require a deep understanding of legal frameworks and practical applications․ Time management during the exam is also a common struggle, as the test is closed-book and includes complex calculations․ Additionally, the integration of securities and advisory concepts can be overwhelming․ To overcome these difficulties, focused study on high-weight topics and regular practice with sample questions are recommended․ Utilizing a structured study guide and seeking clarification on unclear concepts can also help build confidence and mastery of these challenging areas․

Strategies to Overcome Learning Obstacles

To successfully navigate the Series 66 exam, candidates must employ effective learning strategies․ Breaking down complex topics into smaller sections and using active learning techniques, such as flashcards and practice questions, can enhance retention․ Focusing on weak areas identified through practice exams is crucial for improvement․ Utilizing timers during practice tests helps build time management skills, a common challenge․ Additionally, joining study groups or seeking guidance from instructors can provide clarity on difficult concepts․ Regular breaks and a consistent study schedule are essential to maintain focus and avoid burnout․ By combining these strategies, candidates can systematically overcome obstacles and achieve exam success․

Final Preparation Tips

Review notes thoroughly, practice with mock exams, and ensure adequate rest before the test․ Arrive early, stay calm, and manage time effectively during the exam․

Time Management During the Exam

Effective time management is crucial for success in the Series 66 exam․ Allocate approximately two minutes per question to ensure you complete all 110 questions․ Start by skimming through the entire exam to identify easier questions and tackle them first․ Avoid spending too much time on a single question, as this can lead to losing valuable minutes․ If unsure, mark the question and revisit it later․ Use the process of elimination to narrow down answers․ Stay calm and focused, as rushing can lead to errors․ If time permits, review your answers to ensure accuracy․ Proper time management enhances your chances of scoring well․

Staying Calm and Focused

Remaining calm and focused during the Series 66 exam is essential for optimal performance․ Stress can impair concentration, leading to errors․ Practice relaxation techniques such as deep breathing or brief pauses to maintain composure․ A well-rested mind and body contribute significantly to mental clarity; Ensure adequate sleep before the exam and maintain a healthy diet․ Confidence built through thorough preparation helps in staying composed․ Visualize success to boost morale and reduce anxiety․ Remember, it’s a test of knowledge, not a reflection of self-worth․ Stay present, read each question carefully, and trust your preparation․ A calm mindset allows for better problem-solving and decision-making, increasing the likelihood of achieving a high score․